Disclaimer: All information written below is for educational and entertainment purposes only and should not be used otherwise. This is not financial advice and I am not a qualified licensed investment advisor. The items discussed are of my own views, ideas and opinions. All links included are for reference only and their respective organization is responsible for their content. I am not paid or sponsored for any of the ideas discussed below.

Introduction

This series titled Investing Foundations is looking to provide clarity in my thinking and further my investment journey. It’s a framework for investing from past lessons and my latest insights. All of it won’t be set in stone, however, as there is much to be learned and things are bound to change. I do encourage you to correct any errors, or bring to light any items I am unaware of so that I can amend accordingly. I thank you in advance. At the same time, I hope my notes prove fruitful to you whether it’s with new insights or refreshers on basic investing principles.

There are five principles I would like to begin with. The first principle is Circle of Competence or knowing what you own. The second is investing in small cap companies. Though volatile, they have a better chance of growing significantly versus a mega cap company. Third, is demanding a Margin of Safety to better protect your capital from errors or bad events. Fourth, is to ensure the company has a Moat or competitive advantage to keep the business alive for the longer term. Fifth, is to search for companies with Intelligent Iconoclasts or great management. Many great companies have been and continue to be led by great management who do peculiar things which often involve doing the opposite of what their peers do.

1. Circle of Competence

It’s good to know what you own. It is also good to keep yourself updated about the businesses in which your companies operate. You have to be interested in the companies you own. If you aren’t, move on to something else you are interested in. Charlie Munger and Warren Buffett constantly stress to stay within your circle of competence. When you steer outside your circle of competence, you have a higher risk of losing your investment unknowingly. I've also learned over time that you can expand your circle of competency through learning. If you don’t know what you own, something could go wrong, fly right by you, and destroy your hard earned capital.

It is not until after you buy a company do you really begin to understand how the company works and how it should be valued. And a 50% drop in the company’s share price will really test how well you know the company. At that point you will really take a second look, question why you bought the company in the first place, and begin to understand the company at a deeper level. 50% or more drops will also gauge if stock market investing is fit for you, if you can’t stomach a 50% or more unrealized loss, it’s probably best to put your money into some index fund or have someone else manage your money. After all, Peter Lynch did say, the most important organ in the body is not the brain but the stomach.

I’ve heard so many times where individuals would buy a stock simply because they like the company or because someone told them it was a good company. This should not be your only reason you invest in a company. A company could have a wonderful product, but their finances could be terrible making the investment risky. Take General Motors for example. They were one of America’s greatest car companies. However, they had a huge debt burden. In fact, they were borrowing money to pay dividends for their investors to keep their ship afloat at one point. If you had not known about the company’s financial situation and only invested in them because you liked them, their product, and their dividends, that is a recipe for disaster. Know what you own.

2. Invest in Small Cap Companies

“All great companies started as small companies…”-Ian Cassel

The second principle is to invest in small companies. A small cap company is any company valued at $1 billion or less in market cap. A large cap company is valued at $10 Billion or more in market cap. Why invest in small caps? One reason being it’s easier to scale a small cap company than it is to scale a large cap company. It is easier to grow revenues 100x from $10 Million to $1 Billion, than it is from $10 Billion to $1 Trillion. Size becomes a handicap for growth the bigger the company gets.

Alta Fox Capital did a study titled “The Makings of a Multibagger” with summer interns where they looked for companies with a Total shareholder Return (TSR) of more than 350% between 2015 and 2020. Along with a few more criteria, they found and studied 104 companies. From slide 10 (see snip below), they discovered that a majority of the companies that fit within their criteria included small cap companies and smaller ones including micro cap and nano cap companies.

Ian Cassel, in an interview with the We Study Billionaires podcast, provided excellent reasons for focusing on microcap companies. Micro cap companies are companies valued at $300 million or under. He explained there are about 24,000 public companies in North America and about 11,500 of those are considered microcap companies. There are three notable reasons to focus on microcap companies. First, Cassel mentioned, “all great companies started as small companies.” Take Berkshire Hathaway for example. This company was a micro cap company long before Buffet bought out the company in 1964. Second, all the greats began their investing journey in micro cap companies such as Warren Buffet, Peter Lynch, and Joel Greenblatt. They grew out of it because the investments no longer could move the needle to provide significant returns to their overall portfolio.

To explain the ‘moving the needle’ concept a bit further, with a $100 Billion portfolio, $500 Million or .005% of the Assets Under Management (AUM) would fully buy out a microcap company. That would be great for acquirers, but sometimes investment companies prefer to stay a passive investor especially if they don’t want to go through the hassle of filing 13F, 13D, or 13G filings. This usually entails significant ownership or at least a 10% ownership of the company. Thus, the company would only be able to invest less than $50 Million into a microcap company or .0005% of AUM to remain a passive investor. If this investment grows 100x that would be only $5 billion or a 5% increase in the overall AUM. Although the micro cap stock individually performed incredibly well, it was a measly return for the overall AUM.

Third, Investing in small cap companies gives you a competitive advantage. Institutions, the guys with big money, are restricted from buying into microcaps. One reason being illiquidity; They can’t buy and sell in and out of micro cap companies whenever they want to. Not enough shares are being traded on the market. Because they can’t invest in them, micro cap companies are often neglected or overlooked by the big guys.

As a last point on investing in small caps, Charlie Munger mentioned during Berkshire Hathaway’s Annual Meeting @3:18, “the place to look when you’re young is the inefficient markets. You shouldn’t be trying to guess whether one drug company has a better drug pipeline than another. You want to go, when you're young, to someplace that’s very inefficient.” Where are the inefficient markets? These opportunities, inefficiencies, are often found in small cap companies or smaller. If you want to start investing, start looking at small cap companies.

A word of caution

Oftentimes when you invest in small cap companies, you will experience extreme volatility, sometimes more than 50% movements downwards in the share price. If you are able to stomach volatility, you’ll do just fine. A good principle to keep in mind during huge volatility is to focus on value per share over price per share. It helps to focus on what the company is achieving over how the stock price is doing. Oftentimes, there will be disconnects between price and value. It helps to spend less time looking at the day to day price fluctuations within the market. This also helps segregate your rational thinking from your irrational behaviors and emotions. (Easy to just say this, but it’s much harder to practice as I am still working on my own temperament). Plus, the less you do after purchasing a company, if chosen right of course, the better results you’ll likely achieve.

3. Margin of Safety

A simple definition is buying companies for 50% of liquidation value or buying 50 cents on the dollar. An oversimplified, and I emphasize oversimplified, way to find this opportunity is to look at the company’s financial statements. You want to buy the company for half the price of what is listed on their balance sheet under book value.

Of course it’s not always this simple if it was everyone would be doing it. If everyone was doing it, there would no longer be an opportunity. Sometimes, due to reasons such as fear, irrational behavior, or major negative events, could cause the price of the company to be priced below book value. It is the job of the investor to verify what’s in the book. Below are five items to consider when looking at the balance sheet. I’m sure there are plenty more in addition to this.

Is it tangible? It’s easier to look at Tangible Book Value, which include assets that have physical substance. It doesn’t include Goodwill or Other Intangibles or assets that don’t have any physical substance. The intangibles can be from values placed on patents, copyrights, software programs, brand names, and surplus from acquisitions of other companies over book value. Sometimes the intangibles are wildly overstated which could lead to write-downs negatively affecting their balance sheet. If you don’t understand how they value their intangibles, move on.

If the company goes bankrupt, can the company liquidate everything for 100% of book value? When it comes to liquidations during bankruptcy, sometimes the physical assets won’t be able to sell for 100% of their value, they could sell for 50% or 25% or even be deemed worthless. This is often the case for dated machinery where there isn’t much use for it. If the company likely won’t be selling for 100% of book value, revalue their book accordingly and set that new value as your benchmark to gauge the new margin of safety.

Have the books been cooked up by the CFO? There have been a handful of times where numbers were fraudulent or overstated by the company. A Good rule of thumb, if you can’t figure out what is in the book, don’t invest in it. If something looks wrong or out of the ordinary, don’t invest in it.

Sometimes companies may be valued under book for years or decades. This is often the case with holding companies such as Naspers and Berkshire Hathaway. Buying under book value is a possibility but not a guarantee that the company will be revalued to par or substantially above book value.

Is Book Value negative? This is often a sign of a weak company. Companies with negative book value are not uncommon during bull markets. If this type of company files for bankruptcy, you lose all your capital invested into the company. I usually avoid companies with negative book value and especially ones with negative tangible book value.

4. Moat

This is the company’s competitive advantage. It allows for a company to easily fend off hostile competitors from losing business. Ensure the company has some form of moat otherwise it will get beaten up out of existence. Examples of Moats are pricing, patents, brand, technology, and switching. An example of pricing moat is with Costco. Oftentimes Costco provides the lowest prices for their goods. Costco has an extreme example of losing income due to their low prices with their food court items, but this factor is what drives traffic and sales of other items. It will be difficult for another company to replicate Costco’s food court prices, especially during these inflationary times. Patents are straightforward, no one else can copy them for a period of time. Brand moat is probably one of the ultimate types of moats. Take google for example. Do you need to search for something online? Just Google it. Everyone knows that term. An example of a technology moat is Tesla. It is extremely difficult to reproduce their Autopilot and Full Self Driving software without large capital and a large talented engineering team. A switching moat is where it is difficult to change products. Take Gmail for example. It is difficult to switch all your contacts, subscriptions, billings, etc to another type of email platform because it would take way too much time and effort to so.

5. Intelligent Iconoclasts - Great Management

“The smaller the company, the more important the CEO-founder becomes.” -Ian Cassel

The fifth principle is to invest in companies with Great Management. An analogy to the quote above is a sole proprietor where one person has to do everything to keep the company going. In contrast, in large C-Corporations roles have been delegated hopefully to the point where the CEO no longer has to do everything but focus solely on making key decisions to steer the company forward.

Great management consists of Exceptional Leaders that show the ability to allocate capital effectively and efficiently. They are often considered iconoclasts, contrarian thinkers, moving opposite of the crowd. Both the preface and the introduction to The Outsiders by William Thorndike provides an incredible slue of wisdom on great CEOs. Thorndike describes what an Iconoclast is and the word's origin:

“The word iconoclast is derived from Greek and means ‘smasher of icons.’ The word has evolved to have the more general meaning of someone who is determinedly different, proudly eccentric. The original iconoclasts came from outside the societies (and temples) where icons resided; they were challengers of societal norms and conventions, and they were much feared in ancient Greece. The CEOs profiled in this book were not nearly so fearsome, but they did share interesting similarities with their ancient forebears; they were also outsiders, disdaining long-accepted conventional approaches (like paying dividends or avoiding share repurchases) and relishing their unorthodoxy.

Like Singleton, these CEOs consistently made very different decisions than their peers did. They were not, however, blindly contrarian. Theirs was an intelligent iconoclasm informed by careful analysis and often expressed in unusual financial metrics that were distinctly different from industry or Wall Street conventions.”

The CEOs discussed in the Outsiders also

“...shared an interesting set of personal characteristics; they were generally frugal (often legendarily so) and humble, analytical, and understated. They were devoted to their families, often leaving the office early to attend school events. They did not typically relish the outward-facing part of the CEO role. They did not give chamber of commerce speeches, and they did not attend Davos. [Davos is the world economic forum.] They rarely appeared on the covers of business publications and did not write books of management advice. They were not cheerleaders or marketers or backslappers, and they did not exude charisma.” These individuals “on average outperformed the S&P 500 by over twenty times and their peers by over seven times.”

Two most Important Jobs of a CEO

In the preface, Thorndike explained the Job of a CEO. “CEOs need to do two things well to be successful: run their operations efficiently and deploy cash generated by those operations.” While most CEOs only focus on the former. Capital Allocation is the single most important job for a CEO. There are a total of 8 tool sets for capital allocation. There are Five tools for deploying capital and three for raising capital

Deploy Capital:

Investing in existing operations

Acquiring other businesses

Issuing dividends

Paying down debt

Repurchasing Stock

Raise Capital:

Tapping internal cash flow

Issuing Debt

Raising Equity

With only 8 basic tools sets for capital allocation, the job sounds simple. Unfortunately, many companies have mediocre CEOs as many of them don’t know how to efficiently allocate capital. They are but few rare birds. Warren Buffett wrote in Berkshire Hathaway’s 1987 annual report:

“The heads of many companies are not skilled in capital allocation. Their inadequacy is not surprising. Most bosses rise to the top because they have excelled in an area such as marketing, production, engineering, administration, or sometimes, institutional politics. Once they become CEOs, they now must make capital allocation decisions, a critical job that they may have never tackled and that is not easily mastered. To stretch the point, it’s as if the final step for a highly talented musician was not to perform at Carnegie Hall, but instead, to be named Chairman of the Federal Reserve.”

20 Characteristics of Intelligent Iconoclasts

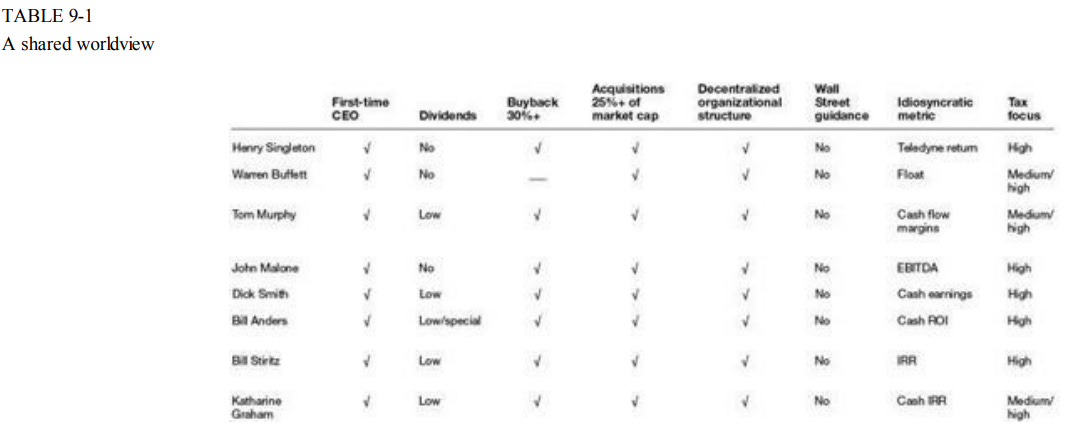

So how might you find these few rare birds? To start, below are 20 characteristics in no particular order of importance that can be used to identify Intelligent Iconoclasts. It will be extremely rare to find a CEO who fits every characteristic. Some of these items stem from Table 9-1 titled “A Shared Worldview” from The Outsiders by Thorndike (see snip below) where he points out similarities between Outsider CEOs, and from Table 9-2 titled “A Profile in Iconoclasm” (see snip below) where Thorndike compares Outsider CEOs with their peer CEOs. Other characteristics stem from studying other great CEOs and even other great investors. Another great resource was from Ian Cassel’s article on “How to find Intelligent Fanatic CEOs Early.”

Intelligent Fanatic = (Long Term Vision + Focus + Energy + Integrity + Intelligence) x Execution, I would argue Intelligent Fanatic = Intelligent Iconoclast

Great Capital Allocators, the most important job, optimally allocates cash flow to grow the company

Focuses on long term growth in value per share, long term cash flow growth

$0 Salary, majority of assets locked in company stock

Multiple successful yet risky bet the company plays

Decentralized organizational structure

Maniacal focus on delighting customers

Scaled Economy Shared, (with Elon I would argue it’s Scaled Innovation Shared where through innovations he drives manufacturing costs and prices lower)

Their “Why” is clear. Their business is easily understandable. Simple.

No Wall Street guidance, little to no interactions with outside advisors (i.e. Wall Street, Media) as it is distracting and time consuming

The have significant ownership of the company in excess of 10%

First time CEOs

Low or no dividend

30%+ share buyback

Acquisitions 25%+ of market cap

Tax focus medium/high

Their operations are located far from Boston/New York corridor (Wall Street)

They don’t give up

They are Foxes which knows many things and not Hedgehogs which knows one thing well

Personal Characteristics, frugal, humble, analytical, understated, family oriented, and doesn’t exude charisma.

Two Examples

The best way to find potential Intelligent Iconoclast is to study other Individuals who have exhibited these traits. There are so many great CEOs in this world and I’ve only learned about a handful so far. The Outsiders is a great place to start where Thorndike wrote about 8 CEOs; Henry Singleton, Warren Buffett, Tom Murphy, John Malone, Dick Smith, Bill Anders, Bill Stiritz, and Katharine Graham. Another good resource was found through Ian Cassel where he shared about Sanjay Bakshi’s Lecture discussing seven Intelligent Fanatics including Siddhartha Lal, Ramesh Dua, Sabu Jacob, Achal Bakeri, Ajit Isaac, Sandeep Engineer, and Kewalchand Jain. There is a link to the transcript here. Of course there are individuals who have been in the limelight these past few years such as Elon Musk, Jeff Bezos, Bill Gates all who have created trillion dollar companies. I’ll briefly summarize two more recent examples including Gary Friedman, and Ryan Cohen.

Gary G. Friedman, Restoration Hardware CEO

A great resource to understand what made Friedman stand out as an Intelligent Iconoclast is through reading his letters. He has a handful of writings which screams Iconoclastic behavior. His most notable was from his 2020 annual letter to shareholders under “Climbing the luxury mountain while building a brand with no peer” He writes that they are working to create a luxury brand from the bottom. He also outlined their business strategy which is opposite of what their peers are doing;

We also understand the strategies we are pursuing – opening the largest specialty retail experiences in our industry, while most are shrinking the size of their retail footprint or closing stores; moving from a promotional to a membership model, while others are increasing promotions, positioning their brands around price versus product; continuing to mail inspiring Source Books, while many are eliminating catalogs; and refusing to follow the herd in self-promotion on social media, instead allowing our brand to be defined by the taste, design, and quality of the products and experiences we are creating – are all in direct conflict with conventional wisdom and the plans being pursued by many in our industry.

We believe when you step back and consider: one, we are building a brand with no peer; two, we are creating a customer experience that cannot be replicated online; and three, we have total control of our brand from concept to customer, you realize what we are building is extremely rare in today’s retail landscape and we would argue, will also prove to be equally valuable.

Another trait was significant share buybacks. Between 2017 through 2020 Restoration Hardware began aggressively buying back stock, ultimately buying back over 50% of their shares outstanding. Since becoming CEO in 2014, the stock has increased 5x with a peak over 11x.

Ryan Cohen, Chewy Founder, Chairman of Gamestop

Ryan Cohen, Chairman of Gamestop, was CEO of Chewy which he founded in 2011 now valued close to $12 billion dollars. Starting Chewy from zero, he has shown, it’s possible to compete with Amazon in niche businesses through; an obsessive focus on delighting the customer, a “Just get it done” mentality for all employees which is a form of decentralized organizational structure, was a great capital allocator, sacrificed short term profitability for long term profitability by reinvesting all their profits back into the company, and is patient to act until the right opportunity arises.

He’s also made some notable moves being Chairman of Gamestop. Within less than a year between 2020 and 2021, Ryan Cohen completely refreshed Gamestop’s board and Executive Officer team. It is remarkable no conflicts nor litigations have risen on this matter. In the process of refreshing the board, the old management team forfeited more than 1.4 Million shares (data from 2022 proxy and form 4 filings here, here, and here) saving the company millions of dollars in costs. The reason was because they failed to meet certain performance targets.

During the insane volatility of Gamestop, on June 22, 2021, Gamestop completed their At-The-Market Equity Offering Program where they issued 5,000,000 shares, an only 6.3% dilution of shares outstanding to raise more than $1.126 Billion, or more than their entire market cap in Gamestop’s stock price trough between 2019-2020. The capital raise has so far provided ample funding towards both their turnaround efforts and new ventures. When the tide recedes they won’t be swimming naked.

What was Ryan Cohen’s performance? First, he created Chewy from zero into a $12 Billion company. Second, Cohen has been key in Gamestop’s turnaround effort so far. Since becoming an activist investor in September 2020 and now Chairman (I know, not exactly a CEO) since April 2021, his unrealized return investing in Gamestop has been in excess of 7x with a peak over 30x due to the short squeeze in January 2021. Cohen still owns about 12% of Gamestop and he hasn’t sold a single share since his first purchases back in 2020.

I’ve only just scratched the surface on how to identify and find Intelligent Iconoclasts. Each one has their own unique set of traits, but as you continue to study more, similarities will begin to appear. Over time it will become easier to spot them. Intelligent Iconoclasts tend to make unusual moves, they like to move opposite of the crowd, and they have a maniacal focus and passion with what they do. They are the ones who create value within a business which ultimately creates significant price appreciation over the long term. This probably should be the most important factor to look for above all the other four principles mentioned above. As a last comment, if you ever do find potential Intelligent Iconoclasts, I am all ears!