Soluna Holdings Inc. (SLNH)

An undervalued asset play run by Intelligent Iconoclasts, a Destination Analysis on Soluna Holdings

Disclaimer: I own shares in SLNH. This is not financial advice and I am not a qualified licensed investment advisor. All information written is for educational and entertainment purposes only and should not be used otherwise. Do your own due diligence or consult a licensed financial advisor before making any and all investment decisions. The items discussed are of my own views, ideas and opinions. All links included are for reference only and their respective organization is responsible for their content. I am not paid or sponsored for any of the ideas discussed below.

Current Market Cap: ~78M (as of 6/15/2022)

Potential Market Cap in 3-5 years: ~$500 Million+

Thesis

Soluna’s business strategy of creating modular data centers powered by renewables while exploiting Bitcoin’s features to help the world transition to renewable energy as a primary power source will become an industry standard in 3 years. They have incredible tailwinds as the macro data centers business will be growing at about 15% CAGR in the next decade. The management team of Intelligent Iconoclasts who own more than 26% of the company, could drive this company towards a potential long term compounder. In addition, with the recent fall in the stock price, this company is also now an undervalued asset play coupled with growth in the multiples from their expansion plans for the near term.

Introduction

Soluna Holdings Inc, builds and develops modular data centers dedicated to mining bitcoin and batchable computing. Unlike many other companies they immediately sell their bitcoins upon mining them.

There are a handful of wonderful writeups; DOMO Capital’s writeup, Kingdom Capital’s writeup, and Shaan Batra’s writeup. Soluna also has a wealth of videos and articles on their company such as this introduction by Michael Toporek, CEO of Soluna Holdings and this dialogue exchanged between Toporek and John Belazaire, CEO of Soluna Computing. Below is my spin on Soluna Holdings.

This write up on Soluna Holdings Inc. will be a start into asking three questions related to Destination Analysis. Destination Analysis is a method derived from Nicholas Sleep and Qais Zakaria from their Nomad Investment Partnership. Investment Masters Class has a great write up about their methods. Sleep Capital wrote another good write up on them too. The three questions are; 1. What is the intended destination or end game for this business in ten or twenty years? 2. Who are the managers, and what must management be doing today to raise the probability of arriving at that destination? 3. What could prevent this company from reaching such a favorable destination?

1. What is the intended destination for this business in ten or twenty years? What is their end game?

There are a few lenses to look at this company from one year, three years, and 10+ years out. We know by Q1 2023 they are looking to energize capacity ramps to over 150 MW (about 3x current levels), and increase their hashrate to over 4EH/s (~4x current levels). This entails a 300% and 400% YoY growth, respectively. See snip below from Soluna.

.

For 3 years out, their strategy is to create data centers 100% powered by renewable energy. The company believes their solution will be the industry standard.

To realize and scale this strategy, they are currently co-locating their modular data centers at renewable energy plants such as wind farms and hydro plants, and purchasing their spillover energy–which would otherwise go wasted–at near lowest cost in the business ($0.025-0.027/KwH). According to Soluna “Up to 30% of solar and wind farm capacity is wasted.” Soluna also sells all their Bitcoins mined. They currently take that income and reinvest it back into the business to continue scaling the business. It’s a win-win arbitrage opportunity for both the power plants (the customer) and Soluna. Power plants are bringing in revenue from power that would otherwise be wasted while Soluna is leveraging both spill over power and Bitcoin features to scale their data centers to be 100% powered by renewable energy.

For 10+ years out, look at their vision. From their about page under “We are cracking the code of stranded renewable energy” they write:

“Why? To help power plants reach their revenue goals. To get more megawatts to the grid. To help make renewable, affordable energy the world’s primary power source. How? By bringing demand to the source, building mobile data centers at the location where power is generated, then applying that energy to the growing worldwide demand for high-intensive computing.”

This company is looking to make renewable, affordable energy the world’s primary power source, especially for data centers as worldwide demand for high-intensive computing increases. This is their end game.

Tailwinds

The business of data centers is expected to grow significantly. With improving networks and tech including 5G, Metaverse, AIoT, IoT, and Autonomous Vehicles. Data centers will be at the core of that to power the digital world. Based on data from a few sources, we can anticipate the data center business to grow at a 15% compounded annual growth rate (CAGR) for the next 10 years.

Cision PR Newswire writes:

“Data centers have benefited greatly from the widespread adoption of the internet of things and cloud computing. Data centers have progressed impressively in both developed and emerging countries, with firms investing in new data storage and deployment facilities. Connected systems have fueled industry expansion and provided several prospects for data center enterprises and knowledge. Over the forecast period of 2022-2032, this would result in a 3.6x increase in market size.

Given the growing demand for cost-effective and energy-saving data centers, as well as increased efficiency and sustainability, the idea of green data centers has gained pace. Data centers are likely to see considerable growth opportunities throughout mature and emerging regions, owing to digitization in every industry. Market participants are capitalizing on the digitization megatrend…”

The United States International Trade Commission's Executive Briefings on Trade Published May 2021 says data processing and storage market is estimated to grow from $56 Billion in 2020 to $90 Billion by 2025. This is a 17.1% CAGR.

Fact.MR’s Data Center Market Outlook (2022-2032) says the current market size value is $77 Billion with a projected global market value at $279 Billion or a CAGR of 13.8%. North America has 34% of the global market share.

Alibaba, from their Investor Day 2021 Cloud Technologies Presentation, estimates the US Cloud market 5-year outlook is a 21% GAGR by 2025 to $380 Billion from $159 Billion in 2020. They believe in a Cloud 3.0, Cloud-Network-Device Convergence, where the network is powered by 5G and the applications include Metaverse, Industrial AIoT, and Autonomous vehicles.

2. Who are the managers, and what must management be doing today to raise the probability of arriving at that destination?

The management team is exhibiting at least four characteristics of Intelligent Iconoclasts. I explained characteristics of Intelligent Iconoclast in my previous writeup.

They are doing the opposite of all other bitcoin mining companies.

While every other company “Hodl’s” entirely or partially, Soluna decided not hodl but sell every Bitcoin they mine. By doing so they are able to maximize their ability to raise as much capital as possible in the nearer term for optimizing their expansion of modular data centers.

Significant insider ownership.

Michael Toporek, CEO of Soluna Holdings Inc., owns 26.71% of the company through Brookstone Partners Acquisition XXIV, L.L.C. With a high insider ownership, management’s interest is aligned with shareholder interest.

Toporek is a Fox and not a hedgehog

His core skill set is an investor in businesses. His circle of competence revolves around a few businesses. Referring to his linkedin account he has an understanding in Managing Investments, Manufacturing Instruments Business, Construction and building products, and Furniture design and Manufacturing, Biotech companies, Manufacturing musical instruments, packaging for pharmaceuticals and cosmetics, and Insurance Underwriting. With his extensive background in multiple business sectors he provides a fresh take on running a data center company.

They are good capital allocators. This can be seen from their low Share Dilution and low debt to equity ratio in comparison to their peers.

Share Dilution

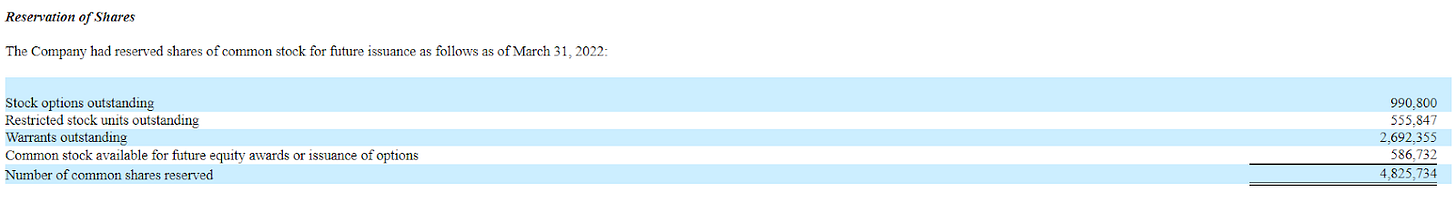

In their First quarter 2022 10-Q Report, management has made it incredibly easy to find future share dilution. Under Reservation of Shares, the number of common shares reserved to be issued is 4,825,734 common shares. See snip below. Common Shares Outstanding is 14,040,149 making future shares outstanding at 18,865,883. From all their methods of raising capital, Management has minimally diluted the future shares outstanding by about 34%.

If you consider share dilution to date, Soluna has diluted shareholders by about 34% so far since 2020. Soluna is on the lower end of the spectrum, see below. Data from Tikr Terminal.

Debt to Equity Ratio

They have used a variety of methods to modestly raise capital including the use of debt ($15.4 Million raise, which includes both their equipment financing and line of credit), promissory notes ($20 Million raise), convertible notes ($15 Million raise), preferred shares (not considered debt), and warrants(not considered debt).

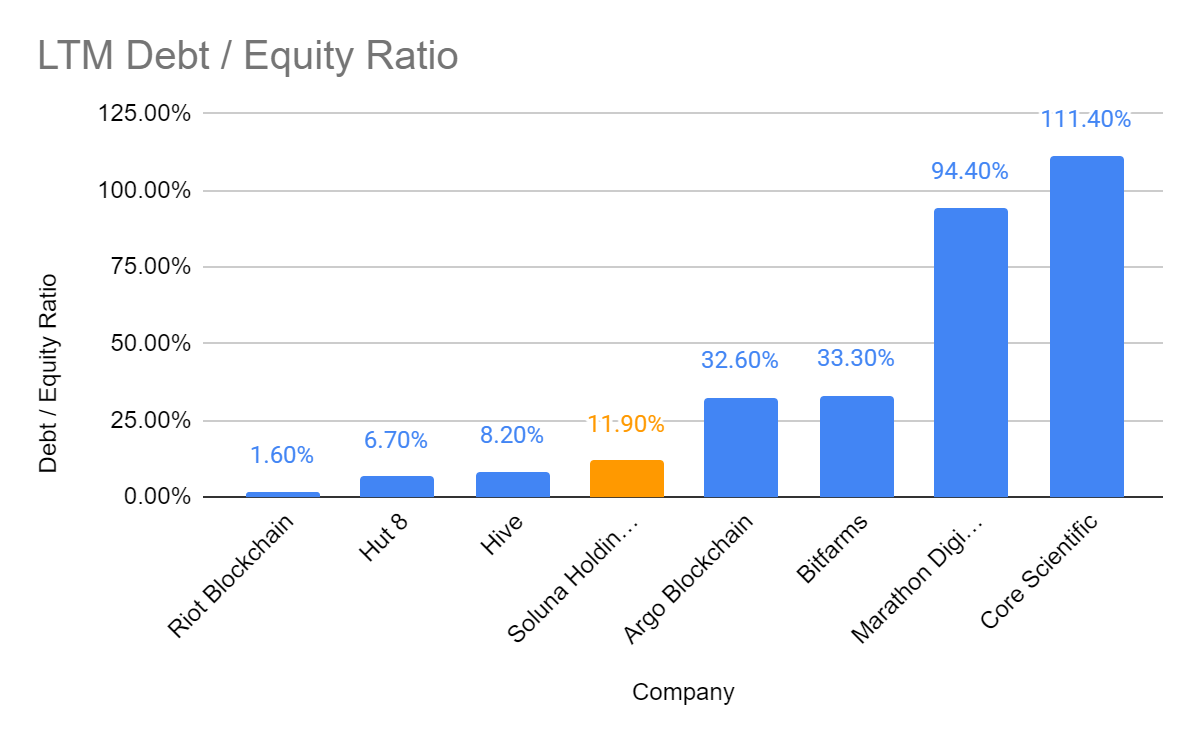

As of April 29, 2022, $20 Million worth of promissory notes was extinguished from their Preferred stock issuance (noted from Shaan Batra’s writeup). They now have total debts of $10.4 Million. Their total equity as of March 31, 2022 was $87.5 Million. Thus their Debt to Equity ratio is about .119 which is low in comparison to their peers. Data from Tikr Terminal.

Hive does look interesting with both lower share dilution and debt to equity ratio compared to Soluna. Correct me if I’m wrong here, but Hive appears to be another public company with their facilities powered entirely by renewable energy including hydro and geothermal power. One downside is their production cost is significantly higher than Soluna at $0.04/KwH.

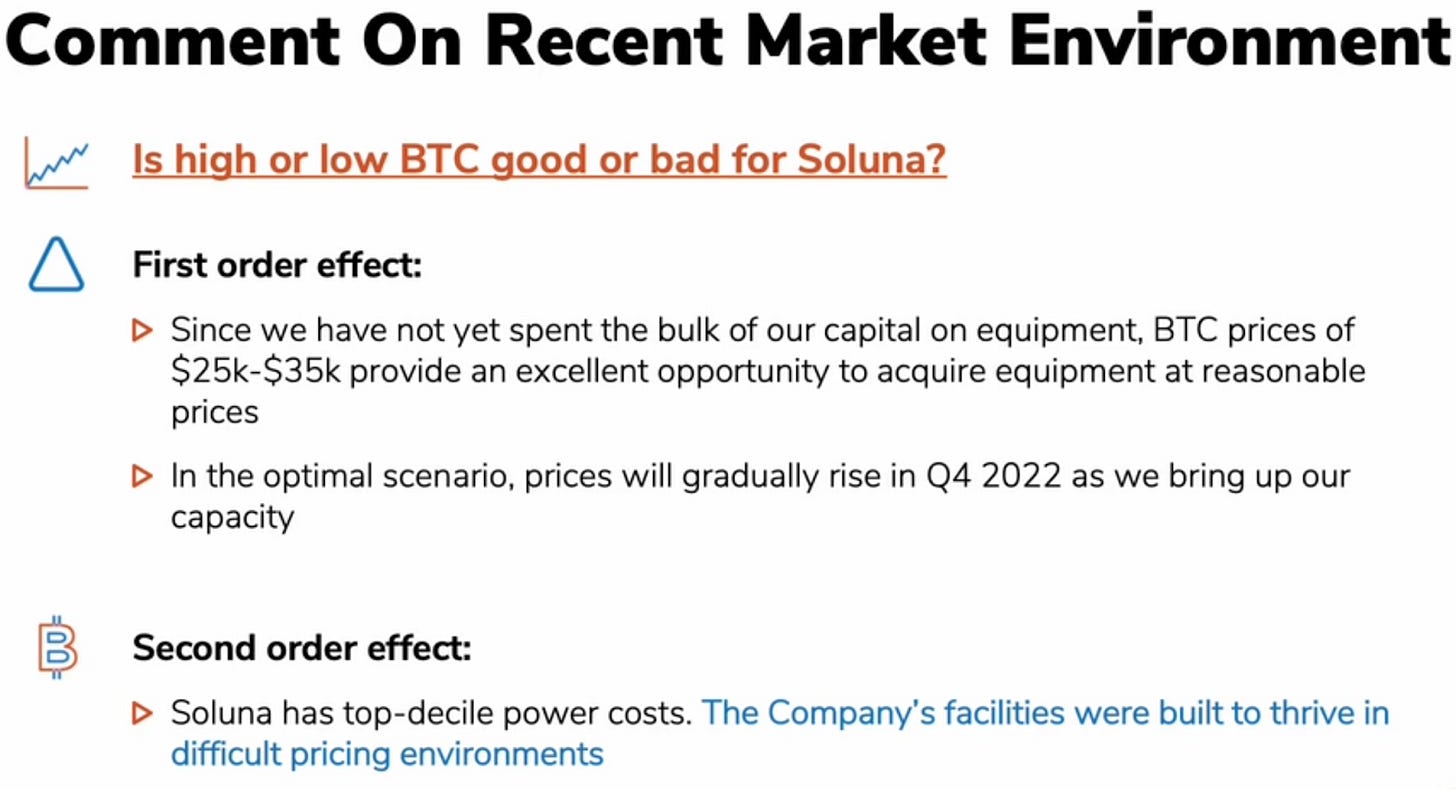

As a last comment, from their April 2022 Flash report @11:59, as BTC prices decrease, capital expenditures will decrease as well. See snip below. Plus, depending on how long crypto winter lasts, higher cost producers will gradually be priced out due to their lack of profitability. Even with bitcoin at $20k Soluna will remain profitable.

What if bitcoin keeps dropping to $10k, or about -85% from all time highs of $69k? This would be a bear case. Such drops have occurred before in Bitcoins lifetime. It is a possibility because of the amount of leverage that has been used to purchase Bitcoin. Referring to the image below, all else equal, if bitcoin falls to $10k FY 2022 Revenues would be about $23 Million, and FY 2022 expenditures are estimated to be about $18 Million. Soluna would still be profitable. Bitcoin could drop down as low as $8k, or about -88% from all time highs, before Soluna would start being unprofitable. If bitcoin drops to $8k, other companies with higher production cost will gradually be priced out beforehand due to unprofitability. A nice competitive moat.

To raise the probability of arriving at their intended destination, management must continue to optimally run their business, optimally allocate their capital, and maintain high levels of insider ownership.

3. What could prevent this company from reaching such a favorable destination?

Like any company, there are a handful of risks, you can get a good understanding of their risk by reading Item 1A. Risk Factors in their 10-K or annual report. Below are a few that stand out which includes

Soluna Holdings is currently in the top tier of the lowest cost operators which provides Soluna a nice competitive moat. It would be a concern if other or emerging competitors are able to operate their data center facilities at significantly lower costs than Soluna. A 100% vertical integration of Data centers powered by 100% renewable energy could affect their competitiveness. For example, there is Blockstream and Jack Dorsey’s emerging Bitcoin Mining project.

Management fails at managing their operations - this includes their missing their goals, ongoing problems, and management changes. Given their track record so far, this probability is unlikely. Nonetheless, it's still a good factor to pay attention to.

Brookstone XXIV owns approximately 26.9% of the company’s outstanding shares of Common stock. If he begins to liquidate significantly, that’s a red flag.

Valuation

As of June 15th, this is an asset play as the company is priced below book. Remember, the company recently paid off $20 Million of their debts through their preferred share offering. With shares outstanding of 14.04 Million (As of May 12, 2022), their revised Shareholder Equity should be about $107 Million or a book value of about $7.64 per share. The stock is currently priced around $5.57, or about 27% below book value. The revised tangible book value is about $4.53 per share; the stock is priced about 23% above tangible book value. You are buying this company below book value today with upside potential. It would be good to keep an eye out for prices below $4.53, the margin of safety will start to look incredibly nice. Note that most of the intangibles come from the values of their permits for their renewable energy data center project pipelines.

From a 10 year lens, we don’t know what Soluna is planning beyond Q1 2023 but we can anticipate further growth. They have tailwinds from the macro data center business growing at more than 15% CAGR for the next 10 years, green Data Centers becoming a business standard, and the upside of Bitcoin increasing in price. If the company is able to grow from today’s market cap of around $70-80 Million at the same rate as the macro business, their potential value would be about $300 Million in 10 years. However, Soluna’s business is expected to grow at least 300% by Q1 2023 from Q1 2022. To stay conservative, if the company is able to grow 50% per year for 5 years, their potential value would be about $500 Million.

Flaws

I'll admit, in doing this writeup, coming to a conclusion on what the valuation should be on my own was a struggle. Soluna has a nice future backdrop, but I realized I am relying heavily on the valuations of what other investors believe in, which can be a personal risk. So take my personal valuations above with a big grain of salt.

Even though the company is priced below book, (a big) if a liquidation does happen the assets will not sell for 100% of liquidation value. The question I wondered is if a 27% margin of safety is enough based on book value, especially as the prices of mining rigs have fallen in synchrony with Bitcoin. Tangible book value is another story as the stock is priced at a premium based on this metric.

The 10 year lens is compelling, but it relies heavily on execution. Management so far does give them a good possibility of getting there. I've yet to come to a more rational valuation metric that isn't so heavily backed by outlook.

Thanks for the write-up. While I agree they do have the potential to scale up and become a much more valuable company, I don't think they will. The continued use of contribution margin, (which is a metric they just made up to make it look like they are making money) is meaningless. How about GAAP profitability? You can't just choose to throw out certain expenses to make it look like you are making money when you are not. Their breakeven level is much higher than even $20k bitcoin, if it's $10k or less, they will be filing chapter 11.

I don't like how they are borrowing at 15%+ now via the preferred. That should tell everyone something about the risk profile of this company. That said, I hope it works out, I just don't see it.